Introduction to Systematic Acquirers

Acquisitions are often viewed as value-destroying which has been referenced by numerous publications. We, however, noticed that this assumption was too broad and overlooked an unrecognised subset of acquirers that consistently generated superior shareholder value over time.

Our research has led us to invest more resources into finding and investing in this specific group of companies. We call these Systematic Acquirers - companies that as part of their core competency execute several acquisitions a year.

Executive Summary

At the beginning of our journey into acquirers, our experience provided an intuitive feel for why Systematic Acquirers should generate alpha. However we needed hard data to support the thesis and investment strategy. To address this, we backtested strategies that invest in Systematic Acquirers. This article will describe the scope of the research and summarise the key results. As a preview of our analysis, we provide a summary of similar studies carried out by McKinsey. Their definitions and analysis differ slightly but they come to a similar conclusion, Systematic Acquisitions are consistent alpha generators.

Acquisitions are broadly seen as value-destroying and this is supported by high-profile cases and academic research1,2. In our opinion, most of this research is flawed in that it fails to distinguish between the size and frequency of acquisition. We summarise a decade's worth of McKinsey papers3,4,5,6,7 highlighting the effect of acquisition size and frequency on excess returns. Following this we summarise the results from the Mckinsey articles.

A summary of McKinsey's research on Acquirers

A McKinsey paper from 2012 measured the excess shareholder returns (vs an index) of the world’s top 1,000 non-banking companies over the period 1999-2010. The study broke the M&A into five groups over a spectrum of size and frequency.

- Organic - almost no M&A

- Tactical - many deals but a low percentage of market cap

- Selective - a small number of deals but a significant market cap acquired

- Programmatic - many deals and a high percentage of market cap acquired

- Large Deals - at least one deal worth 30% of the market cap

When splitting the type of acquisition by size and frequency, the Mckinsey study showed that not all M&A destroys value. In fact, over the period 1999 to 2010, only the group consisting of Large Deals destroyed value (-1.7% alpha per year), and the Programmatic group produced the highest alpha (2.8%). The study also found that the Programmatic acquirers had the lowest variability of excess returns, with the Organic group generating the largest variability. Importanly, McKinsey also found that the volume of deals matters. The more deals the higher the probability it would earn excess returns. The conclusion of our research is quite clear - pursue small and frequent deals that over time amount to a large percentage of market capitalization.

In 2021, McKinsey released another paper with the analysis updated for the period 2010 to 2019. The results were similar to the previous study but even more dramatic. This time, Programmatic acquirers were the only group that generated excess return (2.1%). Large Deals continued to destroy value (-1.3%) and were joined by Selective (-1.3%) and Organic (-2%) acquirers. In 2022, Mckinsey looked at the effect of sales CAGR on Programmatic acquirer’s alpha. Interestingly, the results showed that Programmatic acquirers outperform in all growth regimes, and that the alpha increases with sales CAGR. For companies with a sales CAGR > 5%, the excess return dramatically increases from 2.1% to 5%.

The work done by McKinsey demonstrates that, at least over the past 20 years, companies that have made frequent and small acquisitions have on average generated significant alpha. These studies go a long way in supporting our thesis but needed to go further to determine whether it was relevant to predicting future returns. In addition to the McKinsey data, we used our resources to test this strand of our investment strategy.

Backtesting Systematic Acquirers

For our study, we analysed the performance of Systematic (Programmatic) acquirers from 2012 to 2023 and measured the alpha generated over a 1, 3 and 5-year holding period. Acquirers were chosen from a universe consisting of all North American and Western European stocks with a market cap in excess of $1bn.

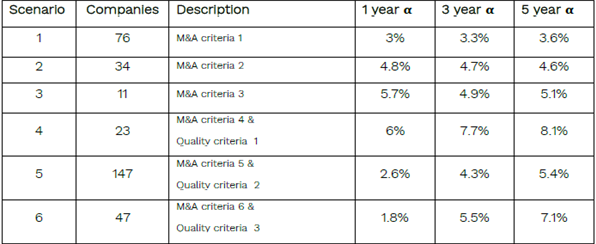

We backtested six different scenarios and analysed the portfolio performance and characteristics from a growth, quality and risk perspective. In each scenario, Systematic acquirers were categorised by calculating acquisition spend as a percentage of Cash Flow from Operations (CFO) generated. Note that this calculation is slightly different to the Mckinsey studies where acquisition spend was measured as a percentage of market cap. The restrictiveness of acquisition spend as a percentage of CFO generated varied between scenarios and in 3 of the 6 scenarios we added qualitative metrics. Below is a summary table, with the full details provided in the CDAM report on the performance of Systematic Acquirers.

Table 1: Alpha by investment scenario

Scenario 1 has the least restrictive criteria, comprising the ‘top of the funnel’ with 76 companies, all with an average market cap of at least $1bn. This group of acquirers was split between the US and the ROW. The number of companies in the scenarios decrease until our quality metrics are introduced. In all scenarios and periods, alpha was consistently generated.

We also note that acquirers consistently perform better than the MSCI world over a 1, 3 and 5-year period. These acquirers also outperform an equally weighted portfolio formed of all stocks in the sample universe.

Finally, although scenarios 1, 2 and 3 are not constrained by any quality or growth metrics, they have a significantly higher ROE than the MSCI world benchmark, with similar leverage and beta.

Conclusion

The results from our backtesting study support our thesis that investing in Systematic Acquirers has, at least for the period 2012-2023, generated alpha. The results are also consistent with the outperformance observed in Mckinsey’s studies. Measuring over 5 years, the annual alpha generation has been significant, ranging from 3.6% in Scenario 1 to 8.1% in Scenario 4. As importantly, analysing the beta and company leverage shows the alpha was created without taking higher risk.

To conclude, our internal research, combined with external studies, greatly supports having exposure to a “Systematic Acquirer” factor in order to generate excess alpha without increasing risk relative to a benchmark.

Written by Cyrus Jahanchahi

References

1 Do M&A deals create or destroy value? A Meta-Analysis, Reinhard MecklI, Falk Röhrle, 2016

2 The Value Killers, Nuno Fernandes, 2020

3 Taking a longer-term look at M&A value creation, 2012

4 programmatic M&A winning in the new normal, 2022

5 how one approach to M&A is more likely to create value than all others, 2021

6 how lots of small M&A deals add up to big value, 2019

7 driving growth in consumer goods through programmatic M&A, 2023

Disclaimer

This document and any attachments are intellectual property owned by CDAM (UK) Limited and are protected by applicable copyright and trademark law.

Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed.

This material is not an invitation to subscribe for shares or interests in any fund and is by way of information only. The information is as of the date(s) indicated in this document, is not complete, is subject to change, and does not contain certain material information regarding any CDAM investment strategy, including tax consequences and risk disclosures. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.