Quarterly Review

The third quarter delivered modest positive returns as our portfolio navigated a complex market environment characterised by extreme speculation and increasing market concentration. While we generated positive absolute returns, the period highlighted the challenges of maintaining a disciplined, fundamentally-driven approach in a market increasingly driven by momentum and thematic investing.

Our year-to-date return continues to be impacted by persistent multiple compression despite solid underlying earnings growth. The portfolio's earnings per share are up approximately 10% since the beginning of 2024, yet this fundamental improvement has not translated into proportionate stock price appreciation. This disconnect reflects broader market dynamics where capital has concentrated in AI-related investments at the expense of high-quality businesses in traditional sectors.

The Market's Speculation Frenzy

The April tariff sell-off, rather than prompting a flight to quality, triggered an unprecedented speculation frenzy. Several indicators suggest we are witnessing one of the most speculative periods in market history:

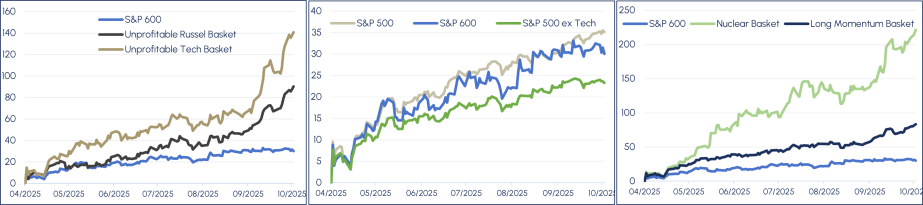

IPO Market Explosion: IPO supply has jumped dramatically, with companies sporting little to no proven business activity achieving extraordinary valuations.

Rampant Speculation Metrics:

- Nuclear-themed stocks have surged despite minimal operational revenues

- Unprofitable technology companies are dramatically outperforming profitable peers

- Small-cap unprofitable companies are trading at valuations typically reserved for proven franchises

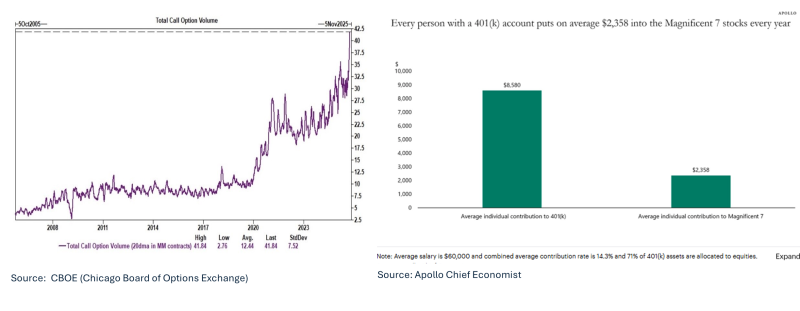

Record Leverage: The amount of direct and indirect leverage layered into the market surpasses all previous periods of speculation-

- FINRA investor credit has reached an all-time high

- Options volume has exploded to unprecedented levels

- Retail participation in highly speculative names has reached extremes

- Individual 401(k) allocations to the Magnificent Seven now represent record concentrations

A Historical Parallel: The K-Shaped Economy

The current market environment bears striking similarities to the late 1990s dot-com era, though with essential differences. We're experiencing what economists call a "K-shaped" recovery, where AI-related sectors surge while traditional industries face recessionary conditions.

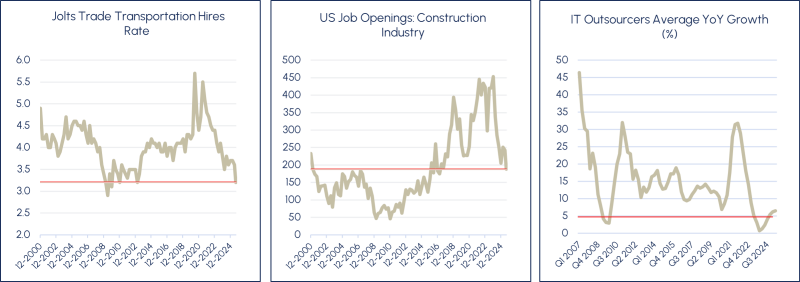

Our portfolio has been disproportionately affected by this bifurcation, with exposure to several sectors experiencing cyclical headwinds:

- Transportation: The JOLTS Trade Transportation Hires Rate shows persistent weakness

- Construction: U.S. job openings in construction have declined sharply

- IT Services: Outsourcing growth has slowed dramatically from historical norms

- Chemicals: Industrial chemicals face demand headwinds

These headwinds are temporary and cyclical, not structural. History shows that when economically sensitive sectors recover, the snapback in earnings and valuations can be dramatic.

Portfolio Review

Despite the challenging environment, our portfolio demonstrated resilience. Q3 delivered a favourable earnings season, with the majority of companies beating expectations, returning to our typical "meet or beat" profile. We ended the quarter with ownership of 20 companies across diverse sectors and geographies.

Q3 2025 experienced elevated portfolio activity, driven by more aggressive rebalancing in response to current market conditions. Heightened volatility in equity markets, particularly around earnings season, necessitated more frequent position adjustments to manage P&L volatility effectively. Active management and hedging strategies added value while managing downside risk, with selective rebalancing and position adjustments contributing to returns.

First Principles: Commitment to Process

Our investment approach is grounded in a fundamental principle: over the medium- to long-term, a stock's return converges with its Earnings Per Share (EPS) growth. While returns generated by changes in valuation multiples can create short-term inflexions, these movements become increasingly less significant to long-term performance.

Our Foundational Formula: Total Shareholder Return (TSR) = Earnings Per Share Growth (EPS) + Change in P/E Multiple + Dividends

The Current Disconnect: Since December 31, 2023, a remarkable divergence has emerged. Despite generating superior earnings growth, our portfolio has experienced severe multiple contraction while the broader market has expanded. Over the past 21 months, the market has returned more than 2x its EPS growth. Meanwhile, our portfolio has not realised any return from its 10% EPS growth due to multiple compression.

Why the Multiple Has Contracted:

- Starting Premium: The portfolio entered 2024 trading at a premium relative to the market, reflecting expectations of multiple interest rate cuts and accelerated growth.

- Gradual Expectation Adjustment: As macroeconomic conditions evolved differently than expected, earnings estimates adjusted slowly, leading to multiple sequential contractions at each quarterly release.

- Heightened Earnings Volatility: The current market structure amplifies price movements on earnings announcement days, leading to outsized reactions to quarterly results.

- AI-Driven Market Rotation: Capital rotated aggressively into AI-themed investments, disproportionately drawing allocations away from other sectors. This thematic concentration drove overall index multiples higher, creating a relative valuation headwind for non-AI holdings.

- Sector-Specific Headwinds: Several industries in the portfolio have experienced extended recessionary conditions, putting additional pressure on near-term sentiment and valuation multiples.

The Path Forward: Research has consistently shown that over five years, approximately 80% of stock returns are explained by EPS growth. Over ten years, nearly 95% of a stock's return is determined by its earnings growth. As returns inevitably converge with EPS growth, we anticipate significant outperformance that will substantially exceed our recent underperformance. The current valuation dislocation presents a compelling risk-reward opportunity for investors.

Long-Term Performance Drivers: Despite near-term market complexities, we remain confident in our portfolio's ability to generate superior long-term returns. Our portfolio continues to have stronger fundamental characteristics relative to broader market indices, whilst trading at extreme valuations. The market has been waiting for a turn in "other stocks" earnings for almost four quarters. Each quarterly disappointment has cost 1-2 turns in P/E multiples. However, we believe this cycle of multiple compression has reached a trough, reducing the risk of further contraction.

Market Analysis: Lessons from History

Market reversals follow a predictable pattern: they begin with a seemingly minor data point that catalyses a cascading reassessment of valuations.

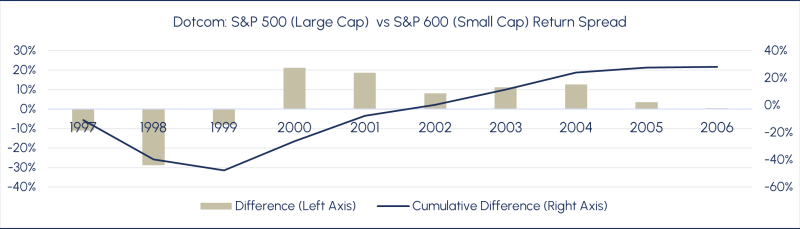

The period leading up to the dot-com crash provides a compelling historical analogue to today's AI-driven market dynamics. When reality inevitably collided with overinflated New Economy stocks, previously neglected sectors delivered annualised outperformance of nearly 10% over the subsequent five years. This complete mean reversion rewarded investors positioned in fundamentally sound but temporarily out-of-favour companies.

The Dot-Com Parallel: From 1997 to 2000, large-cap growth stocks dramatically outperformed small-cap value stocks. From 2000 to 2006, this trend completely reversed, with small-cap value generating cumulative outperformance exceeding 40%.

The current bifurcation between AI beneficiaries and the broader market echoes this historical pattern, suggesting a similar opportunity for disciplined investors focused on valuation and fundamentals rather than thematic momentum.

Current Market Environment: Opportunity Amidst Excess

The current market exhibits several characteristics typically associated with late-cycle speculation:

Speculative Indicators:

- Record retail participation in concentrated positions

- Explosion in options activity

- Unprecedented leverage throughout the system

- The IPO market favours companies with minimal revenues

- Trading as entertainment ("spectator sport" phenomenon)

Valuation Extremes:

- Market concentration rivalling dot-com era peaks

- Small-cap value at multi-decade valuation troughs relative to large-cap growth

- Extreme dispersion between momentum and quality factors

These conditions create both challenges and opportunities. While our portfolio has been negatively affected by these dynamics, they are creating exceptional long-term value opportunities for patient, disciplined investors.

Looking Ahead

We believe the portfolio is positioned for significant outperformance as market dynamics normalise. Several catalysts could trigger this reversal:

Macro Catalysts:

- Federal Reserve rate cuts improving economic conditions for cyclical sectors

- Resolution of trade policy uncertainties

- Normalisation of earnings growth across the broader market

Company-Specific Catalysts:

- Continued execution by management teams

- Increased M&A activity benefiting acquirers in our portfolio

- Margin expansion as operating leverage returns

- Cash deployment at attractive returns

Market Structure Catalysts:

- Mean reversion from extreme momentum and concentration

- Rotation from speculation to quality and fundamentals

- Recognition of valuation opportunities in neglected sectors

Closing Remarks

The third quarter exemplified both the challenges and opportunities in our current investment environment. While speculation and momentum continue to dominate near-term market behaviour, we remain convinced that fundamentals ultimately determine long-term returns.

Our portfolio companies are demonstrating the earnings power we anticipated, with improving trends across multiple sectors. The disconnect between this fundamental progress and stock price performance is creating one of the most compelling value opportunities we have encountered in years.

We are not witnessing a permanent shift in market dynamics—we are experiencing a temporary dislocation that has created significant mispricing. History is replete with examples of similar periods resolving in favour of investors who maintained discipline and focus on business fundamentals.

With our portfolio trading at extremely attractive multiples relative to the market, positioned in high-quality companies with strong returns on capital, managed by aligned leadership teams, and generating accelerating earnings growth, we believe the portfolio is exceptionally well-positioned for the quarters ahead.

The current environment tests patience and conviction. We remain confident that our disciplined, fundamentally-driven approach will generate superior long-term returns for our investors.

Note

This is a redacted version of CDAM's Q3 2025 Investor Newsletter. Should you be interested to learn more, please contact us by emailing ir@cdam.co.uk.

Disclaimers

This document and any attachments are intellectual property owned by CDAM (UK) Limited and are protected by applicable copyright and trademark law.

Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed.

This material is not an invitation to subscribe for shares or interests in any fund and is by way of information only. The information is as of the date(s) indicated in this document, is not complete, is subject to change, and does not contain certain material information regarding any CDAM investment strategy, including tax consequences and risk disclosures. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.